Why Opportunity Zones?

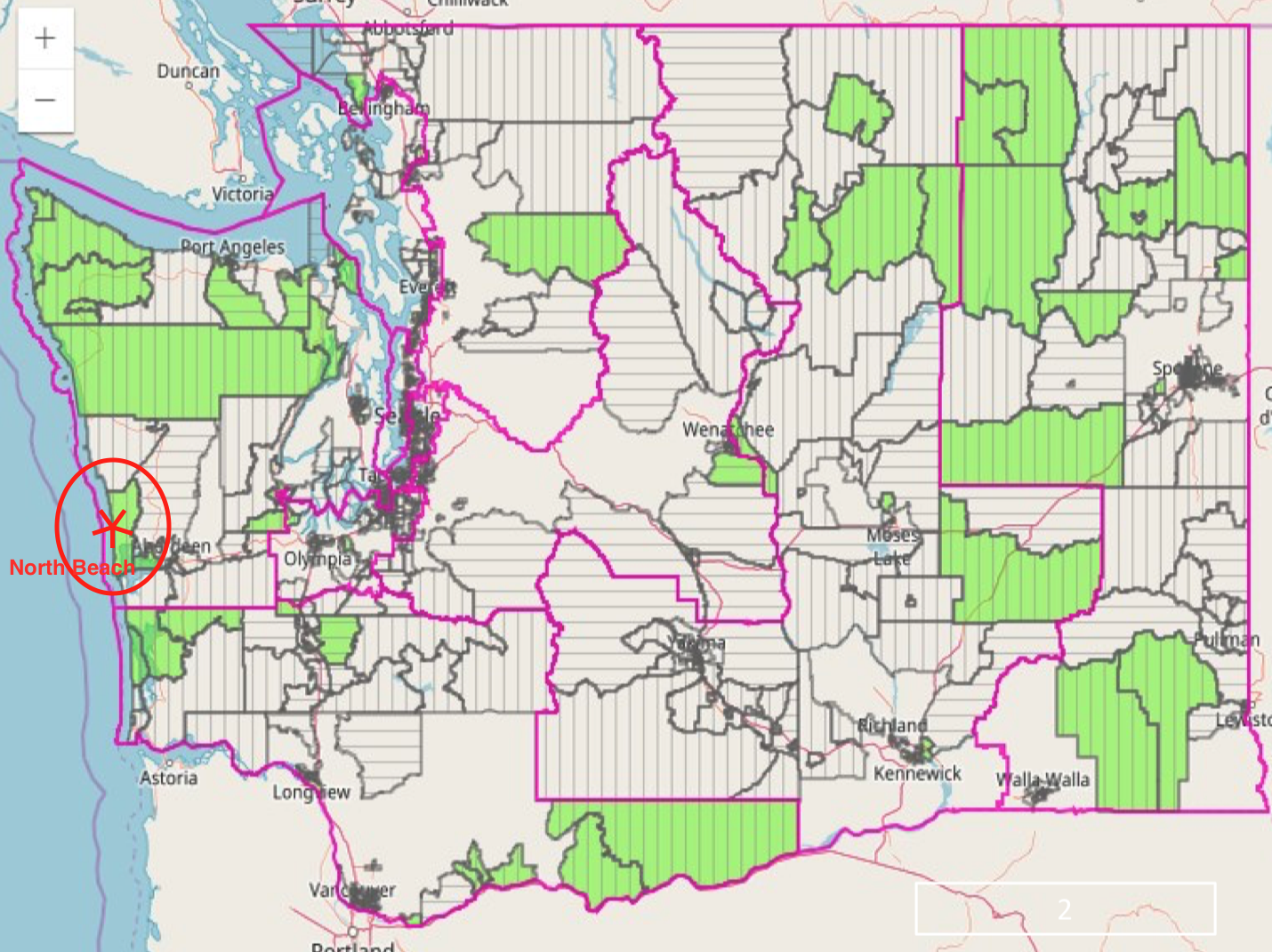

The Tax Cuts and Jobs Act of 2017 included the Opportunity Zone Program, a program designed to offer tax incentives for investors who in invest in viable businesses in underserved communities.

- Investors can defer income tax by investing a realized capital gain into a Qualified Opportunity Zone Fund (within 180 days of realized gain).

- The Qualified Opportunity Fund must be organized as a corporation or partnership with the sole purpose of investing in an Opportunity Zone Property. The initial adjusted basis of the fund is zero.

- The tax deferral is temporary (up to nine years) and the program ends on December 31, 2026. But it also allows taxpayers to exclude from tax any gains that arise from investing in the Opportunity Zone fund if the fund is held for 10+ years

- Need more information? This information was consolidated from Washington State's Dept of Commerce presentation "Opportunity Zones: The Latest"

- Check out the Internal Revenue Service FAQ's on Opportunity Zones.

- Forbes published an interesting article outlining the pros and potential cons of Opportunity Zone investing. Also check out the following flow chart example from Forbes.